WEEK 1 is available for download!

"OWNIT." by Four Seasons, a mini-series designed to empower business owners to take control of their companies before they are consumed by them. Being a business owner can be incredibly rewarding, but it also comes with a unique set of challenges. It's easy to get caught up in the day-to-day operations of running a business and lose sight of the bigger picture. This series aims to provide practical strategies and advice for gaining ownership of your business, so that you can enjoy the benefits of entrepreneurship without feeling overwhelmed or burnt out.

Throughout this series, we will explore topics such as setting clear goals and boundaries, delegating effectively, and creating systems for managing your time and resources. We will also delve into the importance of self-care, financial management, and business growth. Whether you're just starting out or have been running your business for years, "OWNIT." by Four Seasons will provide valuable insights and inspiration to help you take your business to the next level.

We understand that every business is unique, and that there is no one-size-fits-all solution. That's why we will be sharing a variety of perspectives and strategies that you can tailor to your specific needs and goals. So, join us on this journey as we empower you to take ownership of your business and achieve the success you deserve.

******************

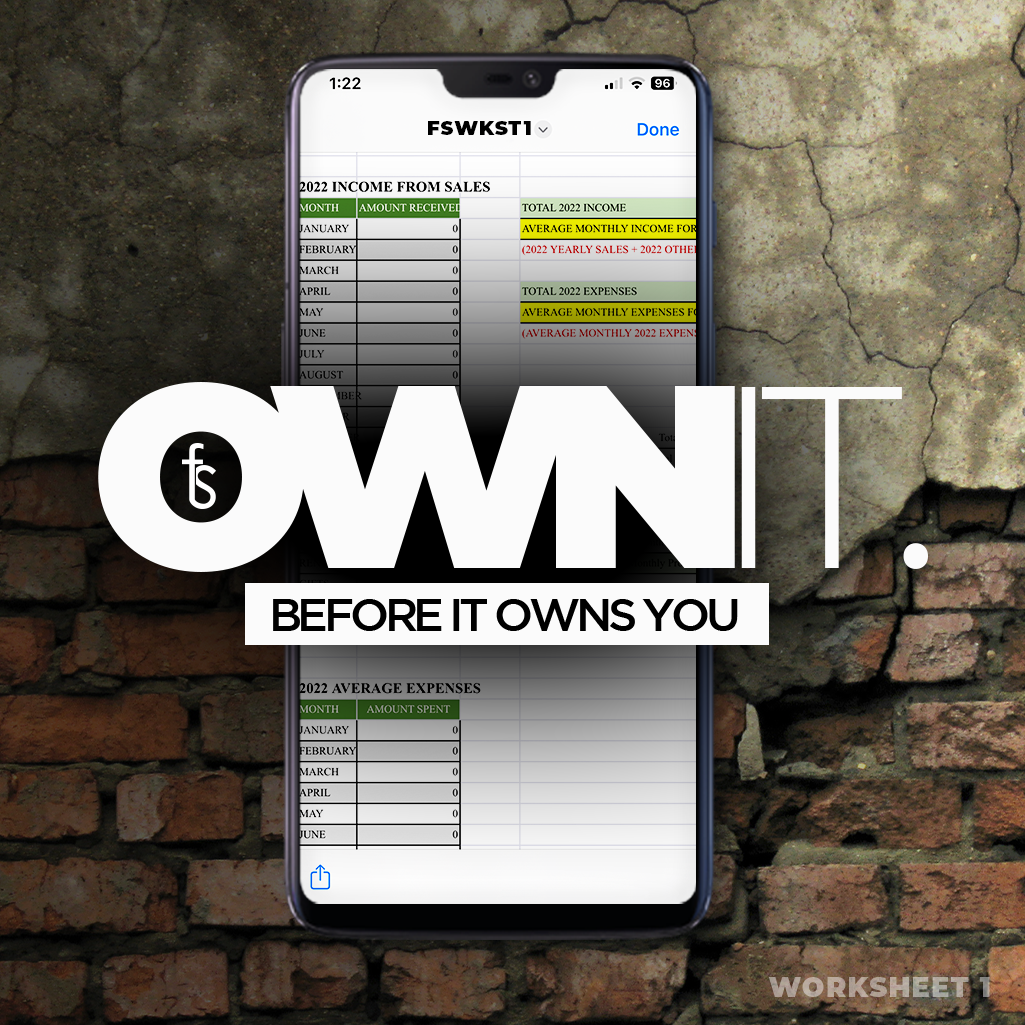

WEEK 1 - It's all about the Benjamins

Using a bank statement to determine your average monthly income and expenses can be a useful tool for budgeting and financial planning. The statement provides a detailed record of all of the money that has been deposited into and withdrawn from your account over a certain period of time. By analyzing the statement, you can get a clear picture of your spending habits and identify areas where you can cut back in order to save money or reach financial goals.

To get started, you will need to gather all of your bank statements for the past 12 months. You can request these statements from your bank or access them online through your bank's website. Once you have all of the statements, you can begin to analyze the information. If you can not gain access to all of 2022 statements, use as many as you can access. However, the more statements utilized, the more accurate the averages will be.

The first step is to look at the deposits section of the statement. This will show you all of the money that you have earned over the past month.

Next look at the withdrawals section of the statement. This will show you all of the money that you have spent from your account over the past month.

Once you have a good understanding of your income and expenses, you can use this information to calculate your average monthly income and expenses. To do this, add up the total income and total expenses for each month, and divide by the number of months. This will give you the average monthly income and expense. We’ve provided a simple worksheet that has the hard part done for you. Just input your monthly data and Wah-Lah!

With this information, you can then create a budget that is based on your average monthly income and expenses. You can also use this information to set financial goals.

Overall, using your bank statement to determine your average monthly income and expenses can be a powerful tool for budgeting and financial planning. It provides a clear picture of your spending habits and helps you identify areas where you can cut back in order to reach your financial goals.

We will look at breaking things down into more detail in the future. ?

DOWNLOAD WORKSHEET HERE: (Works best on PC/MAC)

https://drive.google.com/uc?export=download&id=15P6_mt9_qWRHQrKlA0XzirD7wp5H1Xbj